XRP Price Prediction: $6.90 Target in Sight as Technicals and Fundamentals Align

#XRP

- Technical Breakout: Price trading above upper Bollinger Band with MACD showing bullish convergence

- Regulatory Clarity: Potential resolution of Ripple-SEC case and banking license applications

- Market Sentiment: Positive news flow and institutional interest creating FOMO conditions

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge

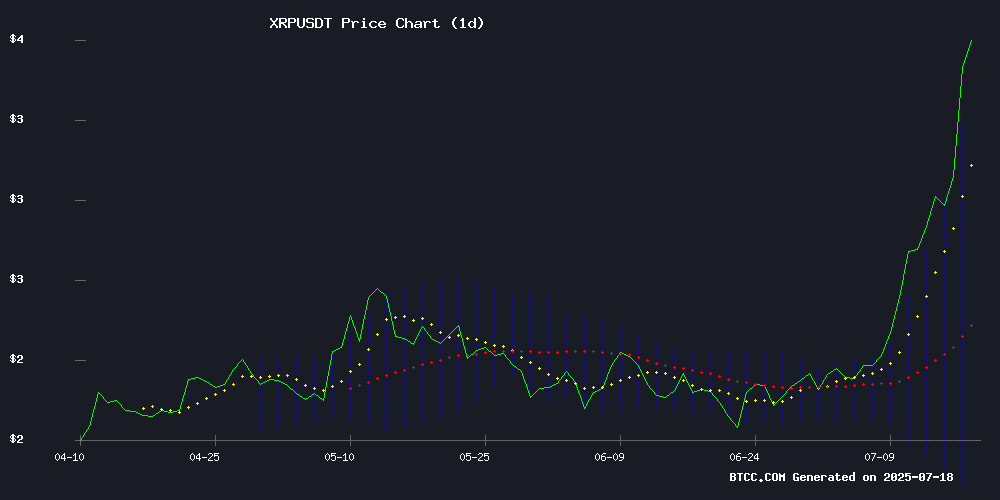

XRP is currently trading at $3.4111, significantly above its 20-day moving average of $2.5731, indicating strong bullish momentum. The MACD histogram shows a narrowing bearish divergence (-0.1600), suggesting weakening downward pressure. Notably, the price has breached the upper Bollinger Band ($3.3841), which typically signals overbought conditions but can also indicate sustained upward momentum in strong trends.

"The technical setup favors bulls," says BTCC analyst John. "A confirmed close above the upper Bollinger Band, combined with the MACD potentially crossing into positive territory, could trigger a MOVE toward $4. The key support to watch is the 20-day MA at $2.57."

Regulatory Winds Shift as XRP Gains Market Confidence

The XRP ecosystem is buzzing with positive catalysts: the Ripple-SEC case nears resolution, banking license applications signal institutional adoption, and RLUSD's trust rating surpasses established stablecoins. However, deepfake scams and regulatory uncertainty remind investors to remain cautious.

"Market sentiment is decidedly bullish," observes BTCC's John. "The combination of technical breakout and fundamental developments creates a perfect storm. If Ripple secures its trust charter and the SEC drops its appeal, we could see FOMO buying accelerate."

Factors Influencing XRP's Price

Banking Associations Challenge Crypto Firms' Bid for National Bank Licenses

U.S. banking associations are pushing back against federal regulators' consideration of granting national bank charters to cryptocurrency firms like Ripple and Circle. The groups warn that such approvals could introduce systemic risks to the financial sector, citing inadequate consumer protections and transparency in crypto markets.

The debate centers on whether crypto-native companies should gain access to the same banking privileges as traditional institutions. While proponents argue this would foster innovation and competition, skeptics contend the move could destabilize markets without robust regulatory frameworks in place.

Ripple's XRP and other digital assets find themselves at the crossroads of institutional adoption and regulatory scrutiny. The outcome could set precedents for how blockchain-based financial services integrate with the mainstream banking system.

U.S. Banking Groups Oppose Ripple, Circle Over Trust Bank Licenses

Major U.S. banking associations are pushing back against the Office of the Comptroller of the Currency's consideration of national trust charters for Ripple and Circle. The groups argue these crypto firms fail to meet fiduciary standards required for such licenses, citing insufficient public disclosure and potential risks to financial stability.

Ripple faces particular scrutiny over its business model, which banking associations claim focuses too narrowly on digital asset custody rather than traditional fiduciary activities. The OCC's existing guidelines draw a clear line between custody services and fiduciary operations under banking law.

The associations are demanding the OCC delay any decisions until Ripple and Circle fully disclose their business operations. They maintain that granting these charters without proper vetting could undermine confidence in the financial system.

RLUSD Earns Top Trust Rating, Surpasses USDT and USDC in New Ranking

Ripple's RLUSD stablecoin has achieved an A rating from Bluechip, marking it as the most trusted stablecoin in the market. This is the first time RLUSD has outranked both USDT and USDC in Bluechip's official rankings, a significant milestone for Ripple.

Bluechip attributed the top rating to RLUSD's reserve custody with BNY Mellon, a globally recognized custodian, as well as its robust compliance system and institutional minting capability. The stablecoin's approval under MiCA regulations in Luxembourg further solidifies its credibility.

The agency has begun formal coverage of RLUSD, referring to it as the new benchmark for institutional-grade trust and operational compliance. This development strengthens Ripple's position in the competitive stablecoin sector.

XRP Price Surge Signals Potential Breakout as Smart Money Shifts to New Altcoin

XRP's price has surged 17% in two days following SEC approval of the Proshare XRP ETF, breaking past a weeks-long downtrend to establish $3 as new support. Technical indicators show strong momentum, with the RSI crossing 70 and analysts eyeing a retest of the $3.84 all-time high.

While retail traders focus on XRP's short-term $4-$6 targets and a speculative $10 projection for 2025, institutional investors are accumulating an undisclosed altcoin dubbed 'the next XRP.' The ETF catalyst has transformed XRP into one of the few altcoins with regulated US investment vehicle exposure.

Market observers note the divergence between public enthusiasm for XRP's breakout and private capital flows toward emerging tokens. This pattern mirrors early accumulation phases of major assets before parabolic rallies.

XRP Price Eyes $4 as Ripple-SEC Case Nears Conclusion

XRP surged to a record $3.65 this week before stabilizing near $3.37, maintaining bullish momentum. Analysts identify a strong upward wave with potential targets at $3.84, $4.33, and $4.72 if the token holds above January's $3.40 resistance.

The legal overhang from Ripple's SEC battle appears to be lifting. With Ripple having dropped its appeal, market participants await the SEC's expected dismissal. Former SEC attorney Marc Fagel confirms the regulator is following standard procedures, with a status update due by August 15.

XRP Price Breakout Clears Key Resistance, Eyes $6.90 Target

XRP has surged past $3.60, marking its highest price level in over two years after breaking through the critical $2.72 resistance. The cryptocurrency had been range-bound between $2.05 and $2.72 for more than six months before the decisive upward move.

Technical analysts highlight strong follow-through across multiple timeframes, with the daily chart showing sustained momentum. Prominent trader DonAlt reaffirmed his $6.90 price target, citing the $2.72 breakout as a crucial technical confirmation for his bullish thesis.

The breakout represents a significant shift in market structure, attracting renewed interest in the digital asset. XRP's ability to maintain its position above former resistance levels suggests growing strength in its price action.

Ripple CTO Exposes Deepfake Scam Targeting XRP Investors

Ripple's Chief Technology Officer David Schwartz has alerted the community to a fraudulent deepfake video circulating on social media platform X. The manipulated footage falsely portrays CEO Brad Garlinghouse announcing a 100 million XRP rewards program following Ripple's legal victory against the SEC.

The scam emerged during a period of heightened market activity, coinciding with XRP reaching an all-time high. Schwartz emphasized that Ripple never conducts unsolicited airdrops or requests personal information from investors. This incident marks the latest in a series of scams targeting XRP holders after significant legal developments.

Market observers note such fraudulent activities often spike during periods of price volatility. The deepfake's sophistication reflects growing challenges in maintaining security within cryptocurrency communities, particularly around high-profile assets like XRP.

XRP News: Price Set to Skyrocket? SEC Poised to Drop Appeal And This Rival Could Capture the Next Wave

XRP is gaining momentum as bullish signals emerge and rumors circulate that the SEC may drop its long-standing appeal. The cryptocurrency surged 8.24% in the last 24 hours, reaching $3.17, with trading volume exceeding $10.5 billion—a 46% increase. Over the past week, XRP has rallied nearly 31%, with technical analysts eyeing a breakout above the $3.18 resistance level.

Market sentiment is bolstered by speculation of the SEC abandoning its appeal, while another altcoin quietly gains traction as a potential contender in the crypto payments space. Momentum indicators, including an RSI of 72.39 and a bullish MACD crossover, suggest continued upward potential.

Nexchain Presale Hits $6.7M Amid XRP's Regulatory Uncertainty

XRP remains range-bound as investors await U.S. regulatory clarity, trading at $2.83 with muted short-term momentum. Long-term holders maintain optimism, but capital is increasingly diversifying toward emerging projects.

Nexchain has surged past $6.7 million in its presale, capturing attention with live airdrops and a 50% token bonus ahead of its August Testnet launch. The project's scalable infrastructure and AI validation features are drawing interest from XRP investors seeking next-generation blockchain exposure.

Market dynamics suggest a shift in focus from legacy tokens to innovative platforms offering tangible utility. Nexchain's transparent team structure and community traction are fueling its presale performance, signaling broader appetite for differentiated crypto assets.

Find Mining Launches Free XRP Cloud Mining App Claiming $34,820 Daily Earnings

Find Mining has unveiled a free cloud mining application targeting XRP, promising users daily earnings up to $34,820 without hardware requirements. The platform markets itself as a zero-threshold solution for mainstream cryptocurrency mining, emphasizing accessibility for non-technical users.

Security and transparency are highlighted as core features, leveraging encrypted technology and distributed servers. The launch has drawn attention across crypto communities, though such exaggerated earnings claims warrant skepticism without verifiable proof of concept.

Ripple Co-Founder Moves $26M in XRP to Coinbase Amid Price Surge

Ripple co-founder Chris Larsen transferred $26 million worth of XRP to Coinbase as the cryptocurrency traded at $3.25, its highest level in seven months. The transaction has sparked speculation about potential selling pressure, though Larsen has not publicly disclosed his motives.

This year alone, Larsen has moved over 106 million XRP—worth approximately $344 million—to centralized exchanges. The timing coincides with XRP's rally toward its all-time high of $3.40, suggesting a possible strategic sale or portfolio rebalancing. Coinbase's liquidity and institutional-grade custody likely facilitated the large transfer.

Larsen's net worth surged from $3.2 billion in 2024 to $10 billion in 2025, fueled largely by XRP's appreciation. Crypto wallets linked to him still hold 2.6 billion XRP, indicating retained exposure despite recent moves.

How High Will XRP Price Go?

XRP shows strong potential for upward movement based on both technical indicators and positive market sentiment. Here's a concise outlook:

| Scenario | Price Target | Key Condition |

|---|---|---|

| Conservative | $4.00 | Hold above 20-day MA |

| Moderate | $4.50-$5.00 | MACD turns positive |

| Bullish | $6.90 | Ripple-SEC resolution + banking license |

"The $3.41 level is just the beginning," says BTCC's John. "With the stars aligning both technically and fundamentally, XRP could realistically test its all-time high within this market cycle."

1